What Can I Use My 529 Money for

You tin withdraw 529 plan savings tax-free to pay for qualified education expenses, which include costs required for the enrollment and attendance at in-state, out-of-state, public and private colleges, universities or other eligible post-secondary educational institution. Qualified 529 plan expenses likewise include up to $10,000 per year in Thou-12 tuition expenses. However, if you don't follow important 529 plan withdrawal rules, you may be discipline to taxes and a penalty.

Information technology's up to the 529 programme account owner to summate the corporeality of the revenue enhancement-gratis distribution and how they want to receive the funds. You can usually brand a withdrawal request on the 529 plan's website, by telephone or by mail.

Hither are four steps to help you navigate the 529 programme withdrawal process and avoid paying taxes and penalties on your savings.

Step 1 – Calculate your qualified education expenses

529 program account owners can withdraw any amount from their 529 plan, merely but qualified distributions volition be revenue enhancement-free. The earnings portion of whatever non-qualified distributions must exist reported on the account possessor's or the beneficiary's federal income tax return and is discipline to income tax and a 10% penalty.

To calculate a 529 programme beneficiary'southward qualified didactics expenses, first add together up:

- Higher expenses , including tuition, fees, books, supplies and equipment, computers and room and lath if the student is enrolled on at to the lowest degree a one-half-time basis

- Yard-12 tuition and fees (up to $10,000 per yr)

Next, subtract whatsoever tax-free educational assistance, including:

- Tax-free scholarships

- Educational assistance through a qualifying employer program

- Veteran's educational help

Next, subtract the amount of whatsoever expenses used to justify the American Opportunity Tax Credit (AOTC) or Lifetime Learning Taxation Credit (LLTC).

For example, a casher who claims the maximum $2,500 AOTC, has $x,000 in qualified expenses and won a $2,000 revenue enhancement-free scholarship may withdraw $4,000 tax-gratuitous from a 529 plan:

$10,000 – $4,000 (used to generate AOTC) – $two,000 (scholarship) = $iv,000 tax-costless 529 plan distribution

In this example, if the 529 plan account owner withdraws more than $4,000 the excess distribution will be considered not-qualified. The earnings portion of the not-qualified distribution is taxable, however, the 10% penalty may exist waived on a not-qualified distribution up to $2,000 (the amount of the beneficiary's scholarship) . Other exceptions to the 10% punishment include:

- Tax-gratuitous educational assistance

- Receipt of pedagogy revenue enhancement credits

- Attendance at a U.S. War machine Service University

- Expiry or disability

- Return of excess distributions

Step 2 – Decide when to withdraw

You should take 529 program distributions during the same year in which you paid for the qualified expenses. For example, do not include second semester tuition expenses that you paid for in December of the previous year.

Step 3 – Make up one's mind which 529 plan account to withdraw from

If the casher has more one 529 plan, consider withdrawing from a parent-owned 529 program account first. Funds withdrawn from a grandparent-owned 529 plan count equally student income on the Complimentary Application for Federal Educatee Aid (FAFSA) and may injure the educatee's eligibility for need-based financial aid.

Nonetheless, a new FAFSA form, which is scheduled to go live on October one, 2022, eliminates the grandparent financial assist trap. The updated FAFSA will not require students to report cash report, including coin from grandparents. And so, any distributions that a grandparent takes from a 529 plan in 2022 or later (due to prior-prior reporting) will not be included in the pupil'due south fiscal aid calculations on the FAFSA. Just, grandparent support is still considered on the CSS Profile class.

Step 4 – Consummate a withdrawal request

Parents tin can withdraw 529 programme funds by completing a withdrawal request form online. Some plans too allow 529 plan account owners to download a withdrawal request form to be mailed in or make a withdrawal request by phone.

The withdrawal request form will typically ask for information such as:

- 529 program account number

- Your proper noun and social security number or Taxpayer Identification Number

- The beneficiary's name and social security number or Taxpayer Identification Number

- Phone number

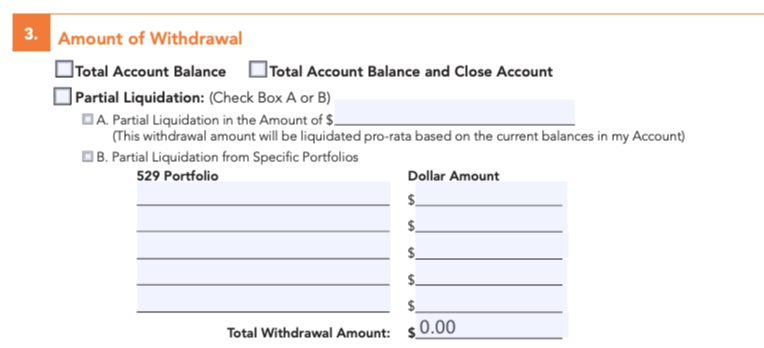

If the 529 plan business relationship owner is taking a partial withdrawal, they will have the choice to select a portfolio or portfolios to withdraw from. The total dollar corporeality entered from each portfolio should equal the total corporeality of the distribution, every bit shown in the image below:

Source: Brightstart Higher Savings Plan

If possible, avoid making the distribution payable to the business relationship owner. When 529 plan distributions are payable to the beneficiary or the casher'due south higher or K-12 school a Form 1099-Q volition be issued to the beneficiary. Non-qualified distributions payable to a parent may result in a higher tax liability.

529 plan funds tin can also be rolled into another business relationship with the aforementioned beneficiary, or into a sibling's 529 plan business relationship.

What happens to leftover funds in a 529 plan?

If there are leftover funds in a 529 program account after the beneficiary graduates from higher, or decides not to go to college, the 529 account owner may:

- Use the money to make pupil loan payments

- Liquidate the account and pay income tax and a 10% penalty on the earnings

- Keep the funds in the account to use for graduate school or standing instruction

- Alter the casher to a qualifying family member who will use the funds for college

- Salvage the funds for a future grandchild

See also:

- Reporting 529 Plan Withdrawals on Your Tax Render

- How Exercise I Select the Correct Investments for My 529 Plan?

- How Much Is Your States 529 Plan Revenue enhancement Deduction Really Worth

thompsonmoded1948.blogspot.com

Source: https://www.savingforcollege.com/article/how-to-withdraw-money-from-your-529-plan

0 Response to "What Can I Use My 529 Money for"

Post a Comment